Artificial intelligence has proven itself in many fields. The Council of Europe defines it as "a discipline [...] whose goal is to have a machine imitating the cognitive abilities of a human being". But do you know how it can help you in your Cash management?

We have heard a lot about the digitalisation of the finance function with the use of different software (TMS, ERP, BI...) in recent years. Now it's the turn of AI and its different levels of automation to be used by treasurers.

We will see how these existing technologies can be applied to treasury, and more specifically to Cash flow forecasting.

The evolution of artificial intelligence

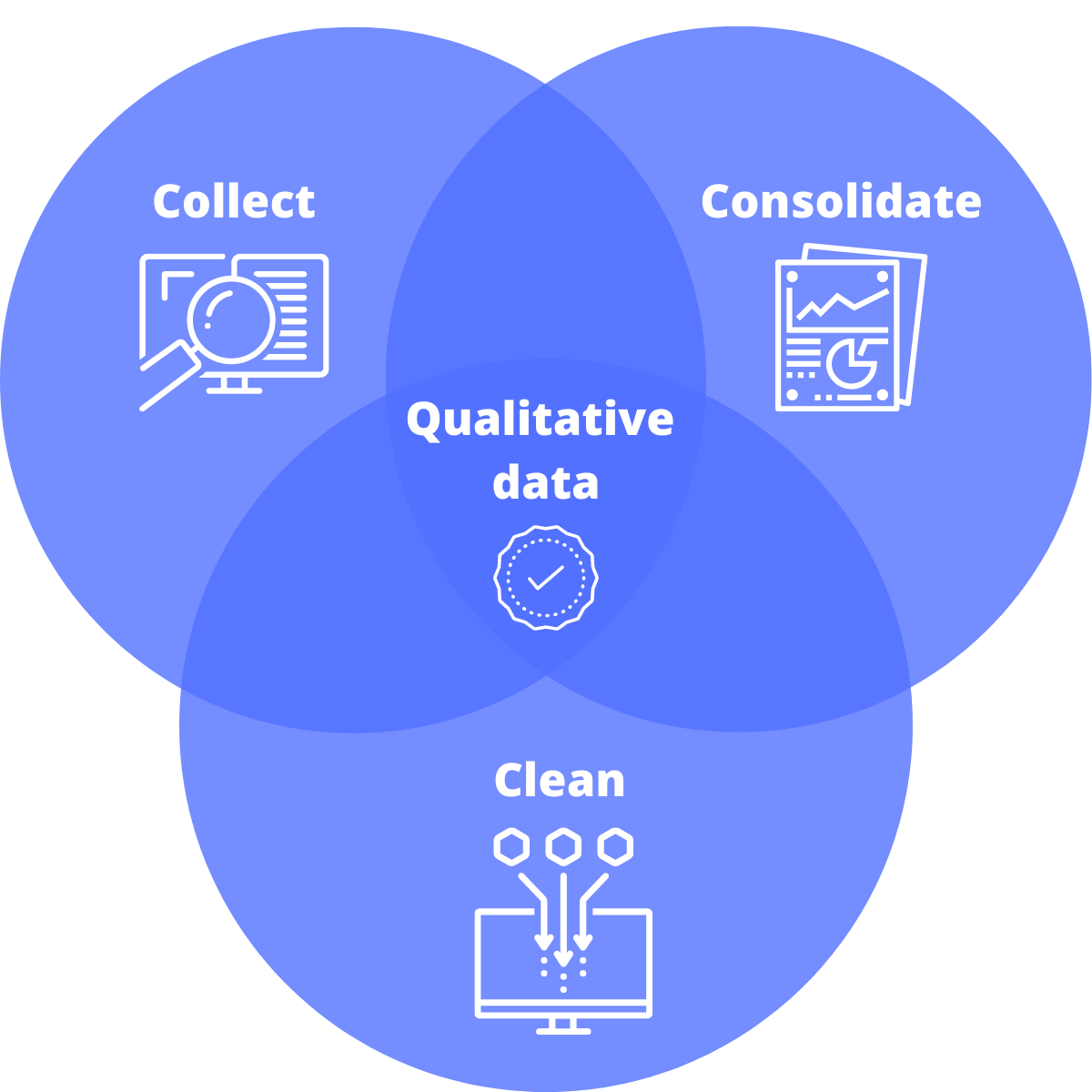

Artificial intelligence (AI) requires high quality and easily accessible data. In order to make good use of it, it needs to be collected, consolidated and cleansed.

Today, a large amount of data is collected, without being properly processed. Indeed, human beings are not able to manage so much data. This is where AI comes in.

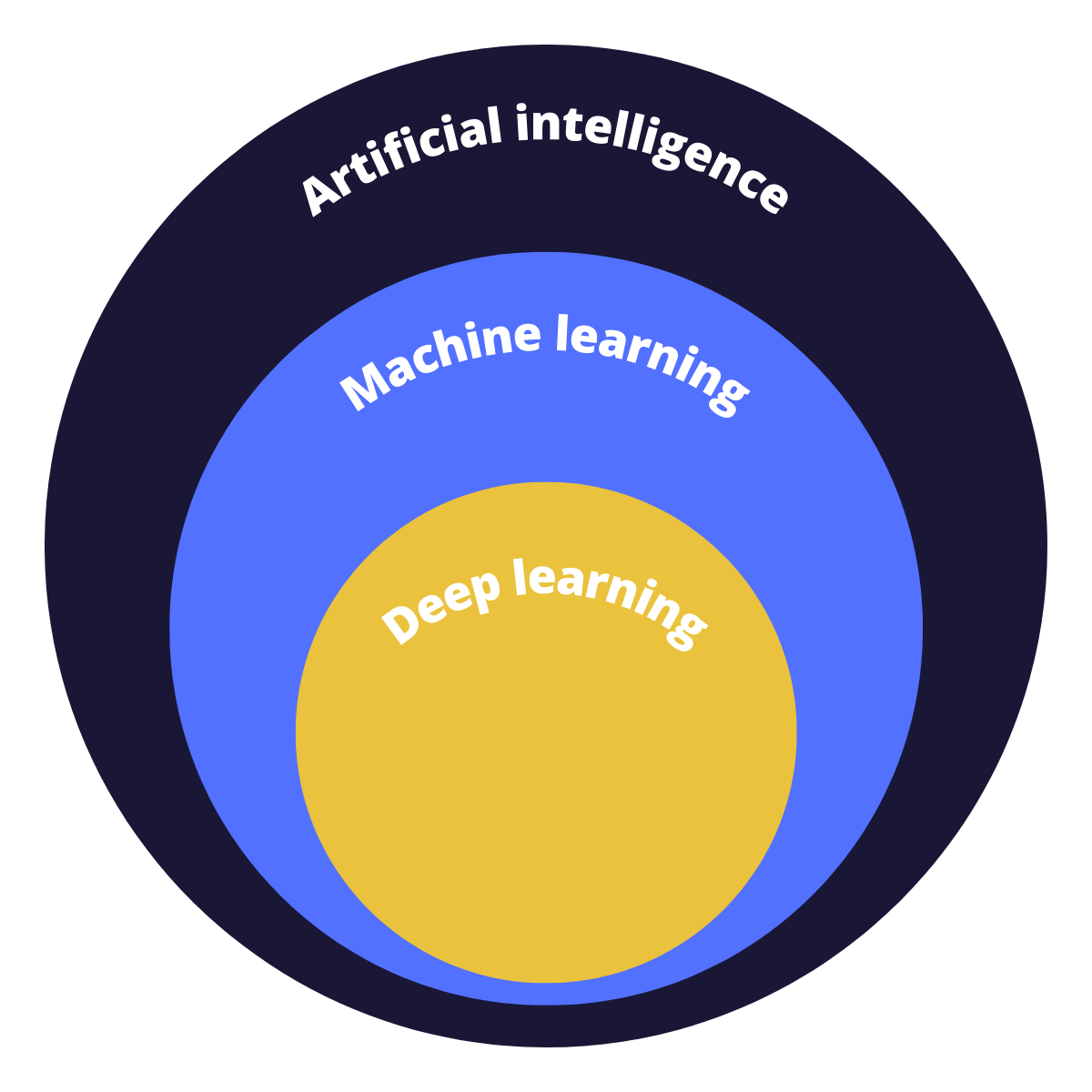

There are different branches of artificial intelligence, including machine learning and deep learning.

What is machine learning?

Machine learning is an automatic learning that identifies patterns. An algorithm learns on its own, by analysing a volume of data that a human being could not process.

Thanks to this, the algorithm can make predictions, and therefore forecasts.

What is deep learning?

Deep learning is even more complex than machine learning. It is an autonomous learning with algorithms that evolve the processing of data. The algorithm learns in stages, also called layers. Deep learning is composed of an artificial neural network organized in layers. At each step, the algorithm will take into account a new characteristic of the data. For example, if we want to teach the algorithm to recognise dogs, it will evaluate each characteristic one by one. At each step, it will take into account the previous one and will be able to absorb a large amount of data.

Forecasting Cash flow with AI

So, what role does artificial intelligence play in Cash management?

As you will have understood, artificial intelligence allows you to process a large volume of data quickly. While automating more and more the learning process. The more data the algorithm absorbs, the more it will learn to analyse autonomously.

In the context of the finance function, AI supports financiers by taking over time-consuming tasks. One example is the automation of accounting data processing. It can rely on data from TMS, ERP and BI to analyse historical flows and improve its learning. The same applies to banking data and the analysis of historical transactions.

Artificial intelligence data processing allows:

- Better visibility into Cash receipts and disbursements. As a result, the financier can identify the company's financing needs.

- A better management of the fixed Cash . Depending on the trends or seasonality identified, the Cash can be optimised by investing it in other activities for example.

- The study of the company's solvency to choose the best credit lines. This will allow them to make the right decisions while reducing risks.

More globally, AI allows to improve Cash flow forecasts and to optimise the resulting actions.

What to remember?

Artificial intelligence is proving to be a valuable ally for finance departments. It enables teams to save time in their day-to-day operations. As well as improving processes already in place.

But beware: you have to take into account the limits of AI. Based on historical data, its forecasts must be put into perspective in the face of unforeseen events (COVID-19, war in Ukraine, etc.).

Hence the need for human control.

The involvement of business experts remains necessary in the use of artificial intelligence. Its goal is to help financiers make faster, more informed decisions. AI takes care of time-consuming activities with low added value, to revalue the finance function.

The application of new technologies to cash management represents the: the future of the finance function.

In the meantime, discover how our tool facilitates Cash management.

Article written by Eléonore Berne, on 11/07/2022.

Interview with Nicolas Quintin and Edouard Fichelle from Carter Cash

Nicolas Quintin and Edouard Fichelle share their experience of optimising cash flow forecasts by adopting Cashlab. ‘The tool is simple to use, with a smooth learning curve and excellent support. With its Saas mode, Cashlab is an up-to-date tool that fits in perfectly with our environment.’

Optimising Cash Flow Management with Defacto

Smooth and efficient cash flow management is one of the most valuable assets of any small business. When money is tight and margins are thin, you need to make sure that every euro is flowing in and out of your business in the best possible way.

Interview with Sébastien Le Nevé, Sage Sales Director

Sébastien Le Nevé explains how our partnership with Sage XRT gives finance departments the means to manage their Cash in the best possible conditions.

![]()

📍1, rue des Prouvaires

75001 Paris

Follow us:

©2023 All rights reserved. | Cashlab | Legal Notice